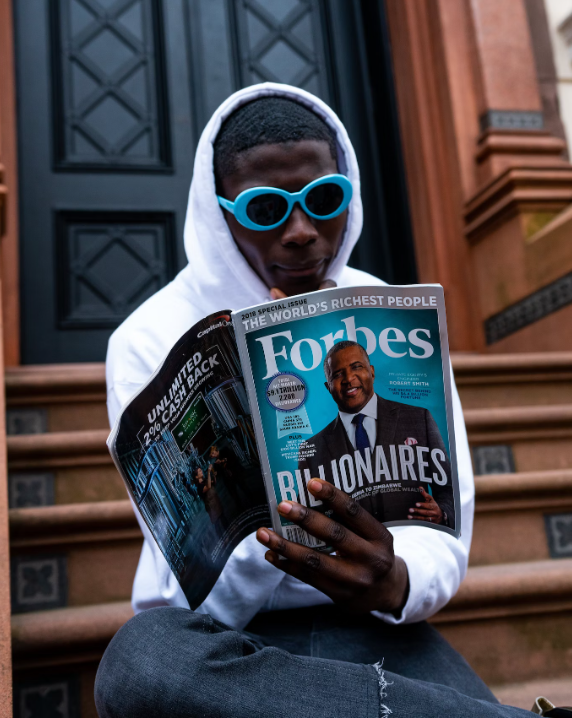

You started your business by yourself, and it’s growing. There’s a chance you’ll make it to the Forbes list, but you’re guaranteed to make some mistakes along the way.

Bookkeeping will be where those mistakes happen, a lot of the time, because it’s a tricky subject that no one is taught until it needs to get done. That’s why even if you’ve been managing your bookkeeping for a while now, you need to know if you’ve been making mistakes and how to avoid them.

Thankfully, you can read on to stay aware of bookkeeping mindsets that simply won’t serve you well in the long run. If you have already identified errors in your current bookkeeping, book a free consultation with us; we’ll hear you out, then fix the issue and make sure it never happens again.

#1: Guessing your way through because you’re busy

Entrepreneurs are typically known to think on their feet. After all, business decisions can’t wait until you know every piece of info and map out every possible outcome. At some point, you just have to go with what seems best at the time. Anyone who has brought that approach to bookkeeping inevitably finds out that small mistakes tend to grow into monsters over time.

If you aren’t sure of what you’re doing, you can be sure more work will be required to fix the same issues later on, and it can be a nightmare to retrace the ripple effect. Pray this doesn’t happen to you at tax time.

What are the most common confusions? Near the top of the list is figuring out eligibility for tax deductions.

A bookkeeper is the best person to help you with that because they’re experienced. A bookkeeper also becomes super familiar with your business in particular. That’s why you can book a free consultation with us to explain your situation and goals before we match you with a bookkeeper.

If you’re immediately dismissing that idea: Yes, you absolutely can do your bookkeeping by yourself — and we can show you how. Just make sure you don’t fall prey to this next mistake.

#2: Wasting more time than you need to

This is what happens when you’re fumbling around with unfamiliar accounting software or a bookkeeping system that isn’t tailored to your type of business.

Another one of the most common bookkeeping confusions is figuring out how to categorize expenses accurately. There’s actually a super easy solution to that: Setting up a chart of accounts.

A chart of accounts lists all the company’s most important categories of transactions and what belongs in them. If you’re looking to log a transaction you’re unsure of, you can glance at the chart of accounts and easily confirm which category to use. Sounds handy, right? Watch the video below to make one.

#3: Putting it off until the anxiety drives you crazy

It’s safe to say bookkeeping isn’t your passion. Maybe it even makes you nervous? You wouldn’t be alone in that; most people wait until their drawers are full to the brim with unorganized receipts, then strap themselves to a chair to endure the frustration of bookkeeping.

We all know that procrastination leads to more stress and more mistakes. But it’s worth knowing how much will be affected:

- Your bank reconciliation

- Your business decisions

- The accuracy of your records

- The extent of your deductions

Let’s make an assessment.

To keep up with bookkeeping, do you need to do it once monthly? Weekly? If it’s more than that, you’re definitely at the point where a bookkeeper is the only reasonable option.

#4: Not knowing who to hire for each type of task

It isn’t uncommon to hire a bookkeeper without knowing what a bookkeeper does — like, actually does. There are a wide variety of tasks you can delegate to a bookkeeper, but below are the most common ones.

A bookkeeper can:

- Monitor your financial data and enter the details into an accounting software

- Create and maintain a chart of accounts so financial data is understood by all staff

- Compile and present reports to give you an idea of how business is going

- Alert you to the most important tasks to be completed for tax or profit purposes

The possibilities go on and on. One thing to remember is that you get what you pay for. You can grab a bookkeeper off Kijiji for $7 an hour. But prepare yourself for $7 worth of professionalism, knowledge, and efficiency.

Here’s the counterintuitive thing about hires. If you only accept higher-value bookkeepers with expertise in your specific industry niche, they’ll get your books sorted faster — which means you actually end up paying less.

This is especially important when you have higher-level tasks that will influence the future of your business. At that point, a CPA is the best hire for anyone serious about growing their business.

The best CPAs will:

- Maximize tax deductions, especially those specific to your niche or obscure

- Execute strategic tax and finance moves to save you money every year

- Explain your obligations for sales tax and what you should do to comply

- Represent you whenever you’re audited by tax authorities

- Identify opportunities for your business to grow and operate more efficiently

- Advise you on the financial implications of your business decisions

If you don’t want to hire a CPA, just make sure you’re able to do each of the above tasks and that you’re able to devote time to them consistently.

Otherwise, invest the money and hire a professional — the money you spend will be nothing compared to the money you save and your rising profits.

Final Thoughts: Now Your Mind’s In The Right Place

Bookkeeping is at the very core of what keeps a small business alive, efficient, and profitable. As you avoid all the pitfalls above, enjoy knowing your livelihood is that much more successful.

If you’d benefit from continued guidance and optimization of your business, book a free consultation with us to discuss your goals.